Do I really need Business Insurance? What are the Business Insurance Basics?

Commercial business insurance can protect you from some unexpected costs of running a business. Accidents, natural disasters, and lawsuits could flip your company upside down or put you completely out of business if you’re not covered with the right insurance policies. In this article we will go over the Business Insurance Basics that you will protect your Company.

Also keep in mind that the choice of an Independent Insurance Broker is important. That decision should be based upon your confidence that they will represent you well and be your advisor and not just a pass-through. The value that a great broker can bring to the table can outweigh the difference in premium between similar insurance policies. When your broker goes through the process of putting your account out to their different markets, they should discuss why they are recommending one company over another and the pricing. They should have a thorough understanding of your company, its operations and why their selections are a good fit for your business.

- Pick the type of business insurance you need

- Six common types of business insurance

- Four steps to buy business insurance

What type of insurance does my company need?

No matter what protections you put in place, it’s not likely that your business will never have a claim. Even when working to put proven business practices in place with regard to standards and safety, Commercial Insurance can fill in the gaps to make sure your assets are protected from unexpected catastrophes.

Worker’s Compensation

Work Comp is a very valuable policy for your business. In the case that an employee has a workplace injury, this type of insurance works to get them healed and back on the job. However, choosing an insurance company to represent you when there is a claim is a big deal and should not be taken lightly. It could be something as simple as tripping down the stairs, to a car accident, to even losing their life. These benefits can help:

- Cover their medical care

- Replace most of their lost wages if they take time to recover

- Provide disability benefits

- Pay for their funeral if they lose their life

Workers’ comp also has benefits for you, as a small business owner. If your injured employee or their family sues your business, it can help cover your legal costs.

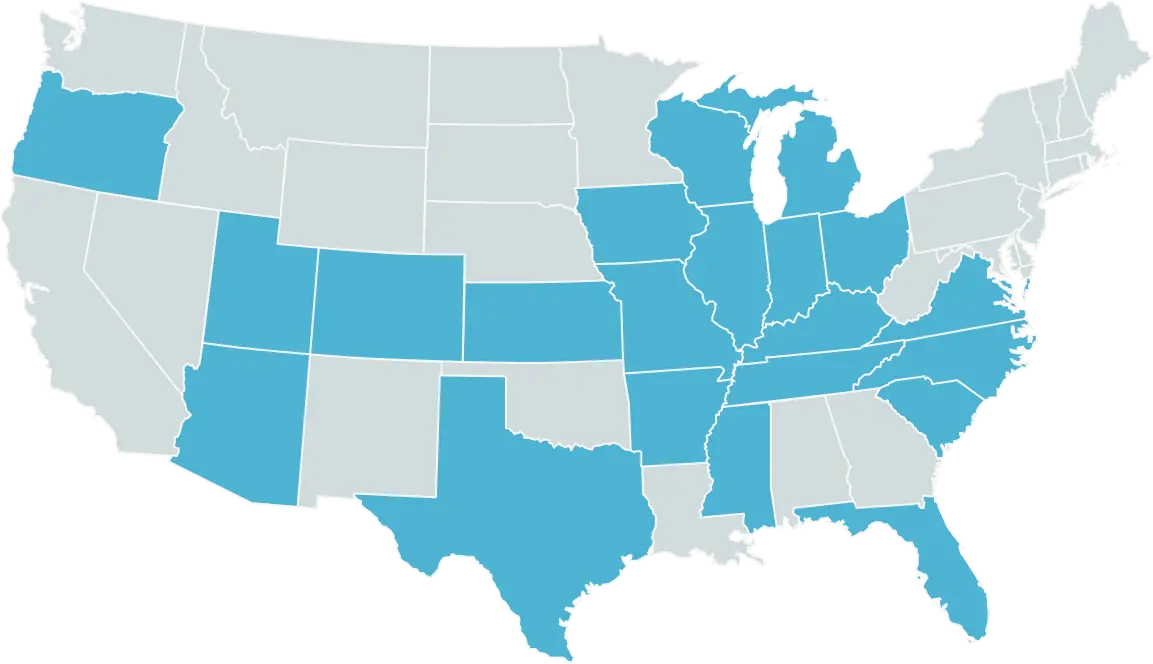

Your state government has regulations on how and when Workers Compensation Insurance is required to be purchased. Please refer to your Independent Insurance Broker for your state’s requirements. Purchasing Workers Compensation Insurance can be one of the most significant expenses for some businesses, so be confident in the Independent Insurance Broker with whom you are working.

The protections you get from choosing a business structure like an LLC or a corporation typically only protect your personal property from lawsuits, and even that protection is limited.

Six common types of business insurance

As a general rule, you should insure against things you wouldn’t be able to pay for on your own.

Speak to an Independent Insurance Broker to find out what kinds of coverage makes the most sense for your business, and compare terms and prices to find the best deal for you. Here are six common kinds of business insurance to look for.

| Insurance type | Who it’s for | What it does |

| General Liability Insurance | Every business. | General liability insurance policies typically cover you and your company for claims involving bodily injuries and property damage resulting from your products, services or operations. It may also cover you if you are held liable for damages to your landlord’s property. |

| Product Liability Insurance | Businesses who manufacture, wholesale, distribute, and retail a product. | Product Liability Insurance — protection against financial loss arising out of the legal liability incurred by an insured because of injury or damage resulting from the use of a covered product |

| Business Auto Insurance | Any business who owns a vehicle or uses vehicles in their operations. | A commercial auto policy that includes auto liability and auto physical damage coverages; other coverages are available by endorsement. Except for auto-related businesses and motor carrier or trucking firms, the business auto policy (BAP) addresses the needs of most commercial entities as respects auto insurance. |

| Professional Liability Insurance | Businesses that provide services to customers. | a type of liability coverage designed to protect traditional professionals (e.g., accountants, attorneys) and quasi-professionals (e.g., real estate brokers, consultants) against liability incurred as a result of errors and omissions in performing their professional services. |

| Commercial Property Insurance | Any business with property and physical assets. | an insurance policy for businesses and other organizations that insures against damage to their buildings and contents due to a covered cause of loss, such as a fire. The policy may also cover loss of income or increase in expenses that results from the property damage |

| Inland Marine Insurance | Any business with ‘in-transit’ property | Property insurance for property in transit over land, certain types of moveable property, instrumentalities of transportation (such as bridges, roads, and piers), instrumentalities of communication (such as television and radio towers), and legal liability exposures of bailees. Many inland marine coverage forms provide coverage without regard to the location of the covered property; these are sometimes called “floater” policies. As a group, inland marine coverage forms are generally broader than property coverage forms. |

| Cyber Liability Insurance | Any business doing business online with access to personal or payment information | A type of insurance designed to cover consumers of technology services or products. More specifically, the policies are intended to cover a variety of both liability and property losses that may result when a business engages in various electronic activities, such as selling on the Internet or collecting data within its internal electronic network.

Most notably, but not exclusively, cyber policies cover a business’ liability for a data breach in which the firm’s customers’ personal information, such as Social Security or credit card numbers, are exposed or stolen by a hacker or other criminal who has gained access to the firm’s electronic network |

| Business Owner’s Policy | Most small business owners. | A package policy that provides both property and liability coverage for eligible small businesses. BOPs are written on special coverage forms that are generally very similar to their monoline property and liability form counterparts, but they typically have some unique features that make them especially advantageous for businesses that qualify |

Steps to buying insurance for your business:

- Find a reputable, licensed Independent Insurance Broker. As an Independent Broker, they have access to find policies through multiple companies which fit the needs of your business most appropriately. The trust you place in this individual and/or team is implicit, as much as any attorney or accountant.

- Work with your broker to assess what’s at risk for your business. What types of catastrophes would damage your business to a point of discomfort and beyond? Ask your Independent Broker what tools they may have to assist you in evaluating what’s at risk for your business and the coverage levels they should have.

- Make certain that your broker is shopping around. Premiums and coverage can vary significantly. Your broker should compare premiums, a policy’s coverage fit for your business, and the benefit for your business from their insurance proposals and recommendations. These proposals should be from several different insurance companies.

- Do a review with them every year. It doesn’t need to take a great deal of time, but as your business grows, so will your need for more coverage and possibly additional policies. As you buy have new equipment, vehicles or added locations and employees, you should seek the input and advice of your Independent Broker.