Flood Insurance is NOT included on all homeowners insurance policies, so you might be asking yourself “What do I need to know about Flood Insurance?” . At Graves Insurance Group we get this question from customers who are purchasing a home, “Why do I have to buy a separate insurance policy for flooding?”. With Flood Insurance there are not a lot of different policies, and we have supplemental coverage to make a robust policy for your home.

The reason for this separate policy is because floods are the most common and most destructive natural disaster in the United States.

With the unpredictability of floods insurance companies will not take the risk on by themselves. Flood insurance is a policy that is backed by the federal government through the National Flood Insurance Program (NFIP) and is available to homeowners, renters, businesses.

What is a Flood?

Flood is defined in the standard flood insurance policy (SFIP), in part, as:

“A general and temporary condition of partial or complete inundation of two or more Acres of normally dry land area or of two or more property (at least one of which you is your property) from overflow of Inland or title Waters, from unusual and rabbit accumulation or runoff of surface waters from any Source, or from mud-flow.” (Standard Flood Insurance Policy, 2018).

Why is my lender requiring the purchase of flood insurance?

Lenders are mandated under the Flood Disaster Protection Act of 1973 and the National Flood Insurance Reform Act of 1994 to require the purchase of flood insurance by property owners who acquire loans from February from federally-regulated, Supervised, or insured financial institutions for the acquisition or Improvement of land, facilities, or structures located within or to be located within and Special Flood Hazard Area (SFHA).

Flood Insurance Requirements

- If your new home is located in a special flood Hazard area, land at high risk of a major flood and you obtain a mortgage from a federally regulated or insured lender, you are required to purchase flood insurance.

- If your home is located in a high flood risk area, your lender must notify you of your requirement to purchase flood insurance within a reasonable time prior to the loan closing. The loan cannot be closed without a flood insurance policy in place.

- The usual 30-day waiting period when purchasing flood insurance is waived if you’re buying a home and you are required to purchase coverage by your lender.

Protect what matters

Without flood insurance, most residents have to pay out-of-pocket or take out loans to repair and replace damaged items. Flood insurance reduces the financial burden of a flood event, and makes it easier to make your house a home again.

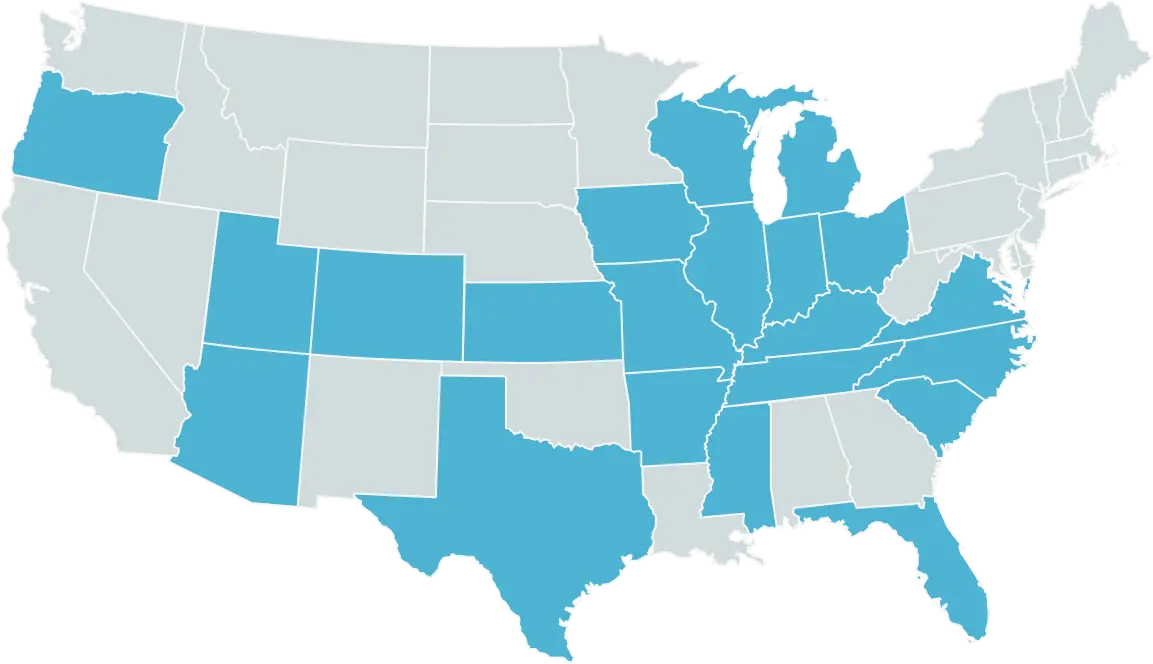

Most homeowner’s insurance does not cover flood damage. Most homes and moderate and low-risk areas qualify for the national flood insurance programs (NFIP) Preferred Risk policy (PRP). PRP’s offer the same quality coverage as a standard flood insurance policy and can cover your home and its contents. PRP’s are available in most communities across the country, wherever flood insurance is available to homeowners and renters.

Flooding is a real risk

Flooding can happen anywhere and anytime, for this reason alone the Federally backed NFIP has developed this plan. Thousands of homeowners and renters have experience devastating flooding events, even though they don’t live near a river or a coastline. In fact, floods are the leading natural disaster in the United States it only takes a few inches of water to cause tens of thousands of dollars in property damage.

Despite the risk, only a fraction of residents protect themselves against the cost of flooding in flood insurance.

Is there a waiting period for flood insurance become effective?

Yes. There is a 30-day waiting period before flood coverage goes in a into effect the effective date of of a new policy will be:

Yes. There is a 30-day waiting period before flood coverage goes in a into effect the effective date of of a new policy will be:

- 12:01 a.m., local time, on the 30th day after the application and the presentment of Premium

There are exceptions in which the 30-day waiting period does not apply:

- In connection with making, increasing, extending, or renewing a loan, whether conventional or otherwise, flood insurance that is initially purchase in connection with making, and cruising, extending, or renewal of a loan shall be effective at the time of loan closing, provided that the policy is applied for and the presentment of Premium is made at the time of or prior to the loan closing.

- In connection with lender requirement, the 30-day waiting period does not apply when flood insurance is required as a result of a Leonard attorney that the loan on a building in a s FHA that does not have flood insurance coverage should be protected by flood insurance. The coverage is effective upon the completion of the application in the presentment of payment of Premium.

- When the initial purchase of a flood insurance is in connection with the revision or updating of a Flood Hazard Boundary Map (FHBM) or Flood Insurance Rate Map (FIRM) during the 13th month. Beginning on the effective date of the map revision the effective date of the new policy shall be 12:01 a.m., local time, following the day after the application date and presentment of premium. This rule applies only when the (FHBM) or (FIRM) is revised to show the building to be in an SFHA when it had not been in an SFHA.

Most homeowners insurance policies do not cover flooding

At Graves Insurance Group we can tell you more about the benefits of flood insurance policy. In the meantime, here are a few things you should know:

- The National Flood Insurance Program (NFIP), administered by the Federal Emergency Management agency FEMA, enables residence in participating communities to purchase federally backed flood insurance.

- In most cases, you can purchase flood coverage from the insurance agent who sells your homeowners policy.

- More than 20% of the flood claims come from outside High flood risk areas you should consider purchasing flood insurance even if you’re not required to do so by your lender.

- If your home is in a low to moderate flood risk area, you could be eligible for a low-cost Preferred Risk policy.

- If your home is in a high-risk area, be aware that longstanding subsidies and discounts are being eliminated get an elevation certificate from the seller so your insurance agent can tell you how much a policy might cost you.

How much flood coverage is available?

The following coverage limits are available under the dwelling form and the general property form of the Standard Flood Insurance Policy (SFIP). Current coverage limits are listed below.

Flood Hazard Zones

Depending on what Flood Hazard Zone your home is located in will determine your cost. You can find your flood zone below.

13 Questions you should ask your Independent Insurance Agent about your insurance policy

-

- What are the key features of a homeowner’s policy, including exclusions and special limits?

- Does homeowners insurance provide guaranteed replacement cost coverage for structure and contents?

- Can I purchase additional coverage insure my valuable such as computer or jewelry?

- Do I need any of these insurance policies wind, flood, earthquake, excess personal liability?

- Is coverage for other structures (ex. fencing, garages) covered under homeowners policy and what is the maximum amount of cover?

- Do I need to add coverage for sewer and drain back up? Can I insure my basement for sump pump failure and water seepage?

- How can I make my home safer and reduce the cost of insurance? Will installing fire or burglar alarms provide me a discount?

- How much does each policy cost? What are my deductible options?

- How much coverage should I consider to protect my financial interest, the equity in my home, and my lender’s interest?

- Where can I find out about this properties flood risk and flood history?

- Do flood insurance maps affect my insurance premium?

- Will my flood premium be different from the current owners?

- How can I find out the flood rate for the structure?

Want more information? Please visit the FEMA website or call Graves Insurance Group at 314-394-2121.