Do you need a better Business Insurance Package?

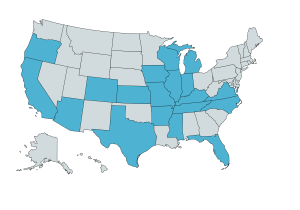

Choosing the right business or commercial insurance plan for your business can be very confusing. To make it easy, we have developed many different options and programs to meet the needs of our commercial insurance clients in the St. Louis area, and throughout the state of Missouri.

At Graves Insurance Group, we can design a specialized package according to your property, liability and casualty needs.

We are also proactive in identifying any factors that may increase your premiums or change your risk, as well as providing consulting and risk management options to protect your business.

Whether you are a retailer, wholesaler, contractor, or electrician, we can tailor a package to meet your specific needs and requirements. So, give us a call today or fill out one of our free online quote forms.

Commercial Package policy vs. Business Owners Policy (BOP)

Think of a Commercial Package Policy as a stereo system where you buy each component individually. So you would buy the receiver, speakers, remote, and every other part and accessory separate from each other.

In contrast, a BOP policy is much like a stereo-in-a-box. All of the pieces you need come pre-packaged.

Business Insurance Products in St. Louis

- Business Owners Packages (BOP)

- Commercial Auto

- Business Personal Property

- Business Umbrella Policies

- Church Insurance

- Restaurants

- Errors and Omissions

- Equipment Floater

- Risk Management

- General Liability

- Contractors

- Retail Stores

- Plumbers

- Professional Offices

- Property Managers & Owners

- Electricians

- Workers Compensation

- Commercial Building Property

- Apartment Owners

- Self-Storage

- Condominium Owners

- Store & Lock Centers

- Retail Stores

- EPLI – Employment Practices Liability Insurance

- Professional Liability Insurance

- Directors & Officers

- Landscapers

- Cyber Liability

- Pollution Liability

- Painters

- Liquor Liability

- Medical Professional

- Service & Repair Insurance

- General Repair Shops

- Garage Keepers

- Auto Body Shops

- Crime

- Inland Marine

- Builders Risk

How to get started with your Business Insurance Comparison

No two businesses are the same, so it’s important to speak to a qualified Business Insurance professional like us, who can sift through your various options. The last thing you want is some cookie-cutter policy that’s riddled with exclusions and limitations.

To get started, call our office or click over to our Quotes page to get started.

Either way, we’ll make the process easy!