Why do my auto insurance rates keep going up even though my car is getting older?

At Graves Insurance, many of our clients ask “Why Do My Auto Insurance Rates Keep Going Up Even Though My Car Keeps Getting Older?”, I would like to address it from a couple of angles.

First things first, even though it’s called car/auto insurance, it covers more than just your car. It should technically be called “auto-owners” insurance, similarly to how home insurance is actually called “home owners insurance”.

It’s important to understand that there are a lot of variables that go into insurance premiums, and with auto insurance, it’s no different.

The insurance company is much more concerned with you crashing into someone and causing them (or yourself) bodily harm, or death, than they are about your car. A car is a material possession which can be replaced.

A human life is not.

When is the last time you looked at your auto insurance policy?

If you look at it you’ll notice there are a lot of different coverages on your auto policy.

Auto Insurance Coverages

-

Bodily injury

- This coverage pays for injury that is sustained in the event of a covered cause of loss.

-

Property damage

- This coverage pays for Damage that your vehicle causes to property in the event of covered cause of loss.

-

Un-insured motorist

- This coverage will pay for your passengers medical bills in the event you are in an accident with another driver who does not have auto insurance.

-

Under-insured motorist

- This coverage will pay for the gap in insurance coverage when you are involved in an accident that you are not at fault and the at fault vehicle doesn’t have adequate coverage to cover you or your passengers.

-

Medical Payments

- This Coverage pays for Doctor’s Bills, X-ray’s. Prostheses, Funeral Costs, Ambulance, EMT Bills, Health Insurance Deductibles, Dental Costs

-

Rental Reimbursement

- This Coverage pays a pre-determined daily amount for a rental car in the case that you have damaged your vehicle from a covered cause of loss.

These are all things that you are covered for on your auto policy. How many of them have to do with your car?

None.

How many of them have a price next to them on your policy?

All of them.

Your car isn’t the only thing you’re being charged for on your policy

That’s because auto insurance covers far more important things than your car as mentioned above.

Let me re-phrase that: your car insurance rate isn’t just based on your car.

You’re not the only one…

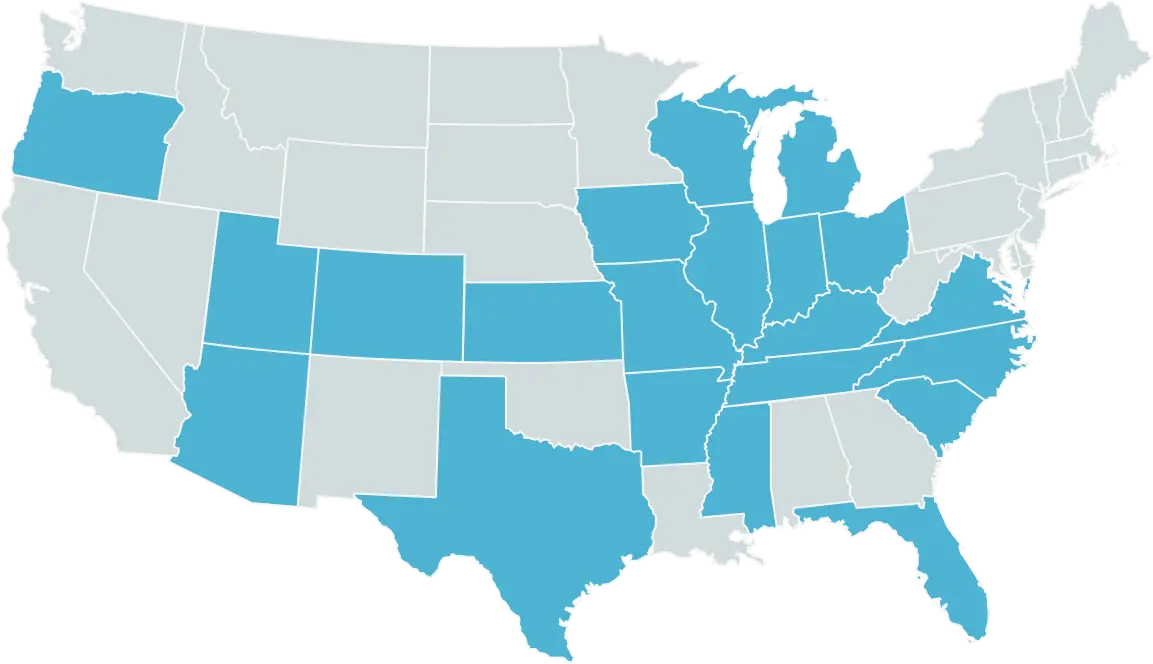

It’s also important to understand that you are not the only person your insurance company insures. You are one fish in an ocean of other fish, sharks, and sea creatures, all who have different characteristics and risk profiles.

Insurance is all about spreading costs over a large number (risk pool) of people, which each person paying their fare share. That risk pool is constantly changing, and is impacted by a ton of different things, including the overall economic climate.

This means that you are sharing in the cost of millions of other people, many of whom may have poor loss history and/or credit.

That’s what insurance is though — sharing in the cost.

The next time your auto insurance rates go up, take a look at the big picture. Make sure you’re looking at ALL of the coverages, and corresponding rates.

Hope this helps! If you would like to know more about Car Insurance be sure to visit our page dedicated to it or start a quote below