What you need to know about Assigned Risk Workers’ Compensation Plans

You own a legitimate business and need to know the ins and outs when it comes to the Assigned Risk Workers’ Compensation Insurance.. You have employees, maybe some vehicles, a location (or two) and you need to make sure that you’re insured properly. When it comes to your employees, you offer them a health plan, but is that enough? If they’re hurt on the job, then the answer is a resounding ‘NO’.

Small operators are faced with difficult decisions when it comes to Work Comp. If they join the ‘Pool’, it’s like they are starting at the bottom. In the eyes of insurance brokers, the Assigned Risk Plan, also known as the ‘Pool’ is the market of last resort, meaning that they just have no other place to put your Work Comp policy. Generally speaking, standard insurance carriers are looking for some qualifications; three years of history, clean loss history and a proven track record of keeping a Workers’ Compensation policy paid up and in place. Sometimes you can find a market who’ll take you, otherwise you’re faced with jumping into the Pool.

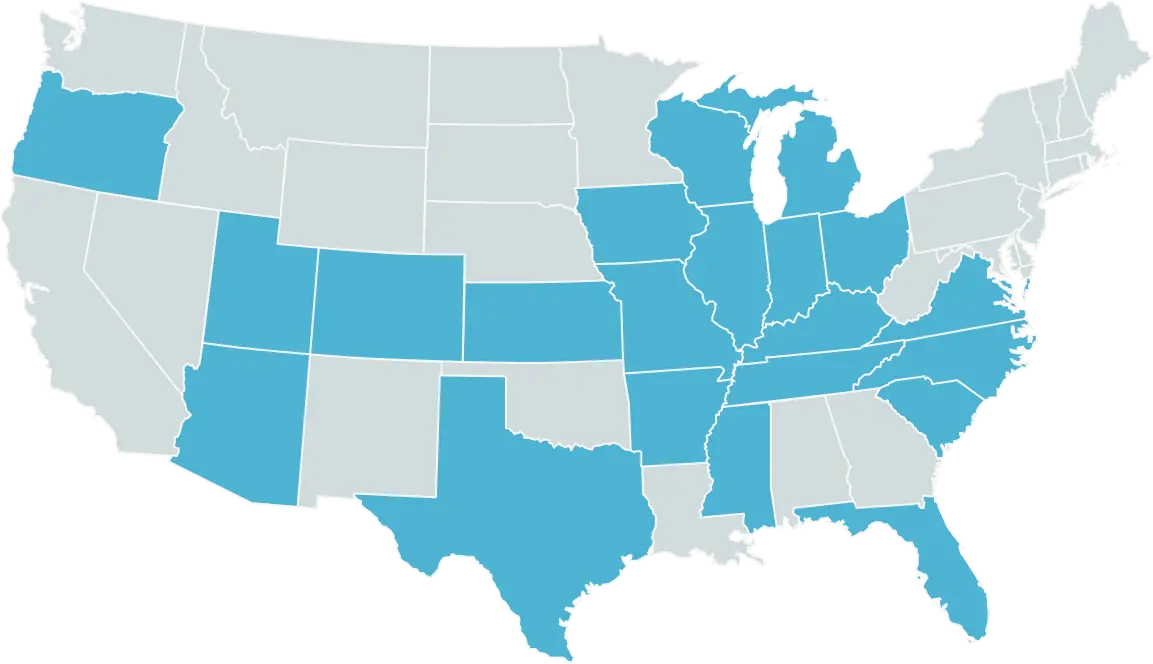

Some of you might be asking yourself ‘Why do I need Workers’ Compensation?’ Great question. It may be mandated within your state, or the states in which you do business, it’s what responsible employers do for their workers in the case that there’s an injury and it also protects your company from lawsuits from workers injured while working. Even what seems like the most benign of injuries can turn into something very serious. So, why do you need it? Because you care about the people you employ and that your company will be able to continue in business.

For some, the Pool may be the only place where you could find coverage. For example, if your company erects steel or iron frame structures or runs a salvage operation, you could be in for a shock when you find out how much the ‘Pool’ has to charge you to cover your employees for a workplace injury. Just because you have an acceptable class of employees for a standard policy, you may not qualify because of your Experience Modification or ‘Mod’ for short. The Mod is the modifier or modification which adjusts your premium based upon your Actual loss history divided by Expected losses . If you’re an employer with minimal or no losses, then your Mod adjusts to give you a discount. However, I’ve seen Work Comp Mods above a 3.0. The starting point for all new businesses is 1.0. That means that there is no adjustment. If your Mod is 3.0, you would be paying 3x of your premium. I know, it’s painful.

Let’s talk about the Pros and Cons of the Pool’ though. It’s important to know just what you’re getting into when you stick your toes in the shallow end…

Pros: For the Assigned Risk Workers Comp Insurance

- You always have a place to go to get covered for Workers’ Compensation.

That’s about it. There’s not really any more benefit to being in the Pool except knowing that you have somewhere to go, no matter how bad your situation is.

Cons: For the Assigned Risk Workers Comp Insurance

- Little to no assistance with Loss Control. As your company gets bigger, you need help. Larger insurance companies in the standard market have Loss Control folks to help you by doing reviews of different aspects of your company’s jobs. They can help you to lessen the frequency or severity of injuries through their experience. In some cases, even eliminate the source of injuries.

- Proper assignment of Class Codes. These Codes are how your company is charged for your Work Comp policy. This can stem from several avenues: incomplete job descriptions, an inexperienced broker, or the opinion of the auditor seeing and reviewing your account at the time of renewal. If you misclassify an employee into a Class Code which is a lower cost, after an audit you will owe all of the back-premium for that misclassification.

- Audit Non-Compliance Charge. Oh yes, they can levy a charge if you do not comply with a request to complete the audit phase as the policy requires, generally at the end of the policy term. IF you don’t complete the audit, the penalty can be 2x or 3x of the original premium, plus the carrier has the right to cancel your current Work Comp policy for failure to comply.

Lastly, let’s talk about the role of the broker in all of this. The inexperience of a broker will lend itself to a potentially negative impact on an employer looking for Work Comp and especially if the employer is needing to be placed into the Pool. Be very selective when choosing someone with Workers’ Compensation experience and ensure they do their due diligence on your company, your employees and job descriptions. If the broker doesn’t understand the ‘what’, ‘how’, ‘where’ and ‘how much’, they cannot successfully place your Workers’ Compensation with accuracy. You can’t fault them when an employee switches positions, job descriptions change, or your company has a shift in what you do and how you do it. Clear and regular communication with your broker is expected, when your company has any changes throughout the year.

My final thought is this; if you don’t want to play in the Pool, then learn to swim well and choose your stroke carefully. Communicate with the Lifeguard. If you do the laps incorrectly, it could drown your company. Graves Insurance Group can provide you with the tools and experience to structure your Workers’ Compensation plan and other Business Insurance Basics . You can start your quote below or schedule an appointment to discuss your particular situation.